Results of the survey show modest levels of adoption of many digital technologies, and substantial differences of adoption among precision agriculture tools and for the financial returns to the dealership. But dealers identify several technologies poised for rapid growth in the next few years.

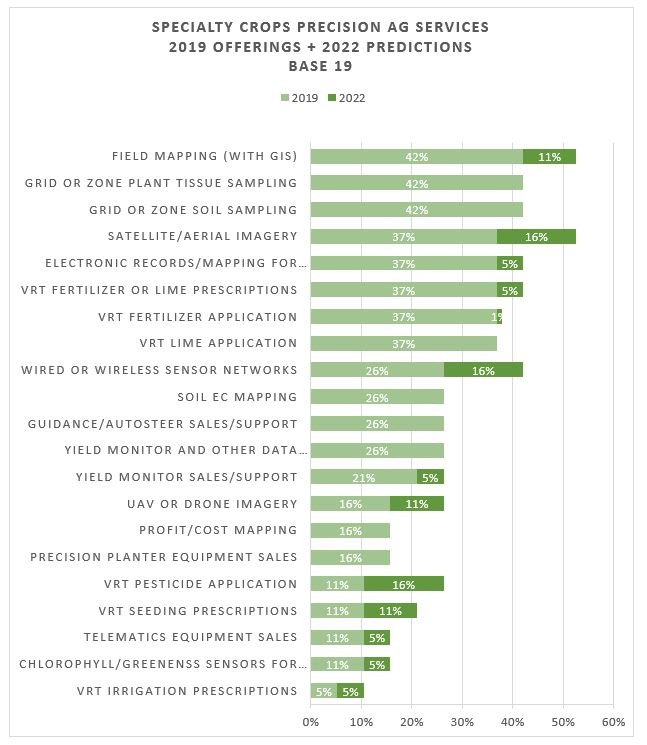

Figure 1. (Click to see full size.)

For their current offerings to growers, commonly supplied services included helping customers map their fields, conducting precision soil sampling, and precision sampling of plant tissue.

Following closely were satellite/aerial imagery offerings to customers, electronic records/mapping for quality traceability, variable rate technology (VRT) application of fertilizer or lime prescriptions, and VRT fertilizer or lime applications.

Dealers were also asked to look beyond their current offerings and identify what they might be offering three years out, in 2022. Among dealers who are not offering them now, they indicate they will add satellite/aerial imagery, wired or wireless sensor networks, and VRT pesticide applications to their portfolios.

With each of these three precision offerings, technology advancements have increased the potential value they could offer farmers in the future. It should be noted that this data represents the percent of dealers offering these services now or what they plan for the future, not the percent of acres where these services were applied.

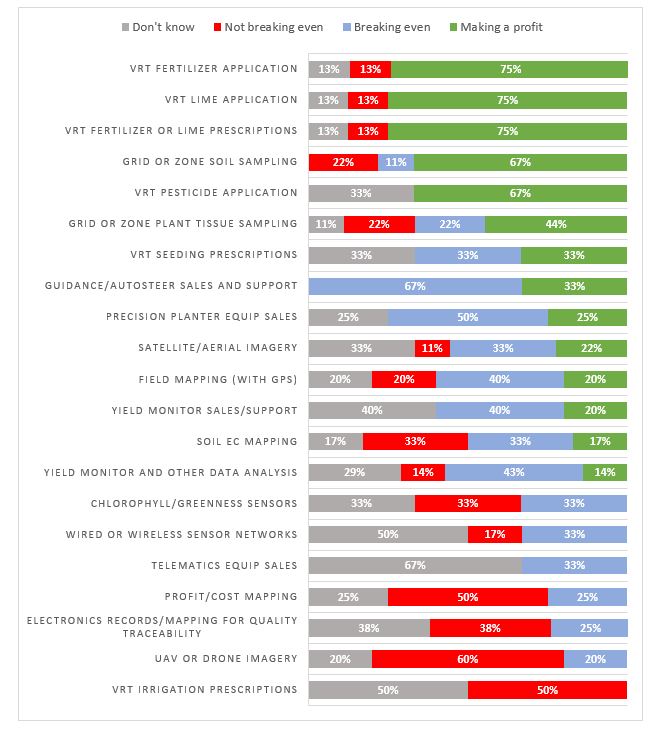

Figure 2. (Click to see full size.)

Specialty crop dealers reported an exceptionally wide range of profitability among the precision products and services they offer to customers (Figure 2). An outright positive return for a particular service offering isn’t always necessary to help a dealership stay in the black — it sure helps, but the value can often be indirect, such as enhancing customer relationships or providing a product or service not available from a competitor. Among the most profitable types of offerings are those related to precision nutrient management, where three-fourths of dealers indicated their VRT fertilizer and liming prescriptions as well as their VRT fertilizer and lime applications were making a profit, and two-thirds said their precision soil sampling was profitable.

No dealers indicated turning a profit for plant chlorophyll/greenness sensors, or for sensor networks, telematics sales, profit/cost mapping, traceability records/mapping, or UAV/droneimagery. With the exception of sensor networks, these are all services that only a small number of the dealers offer.

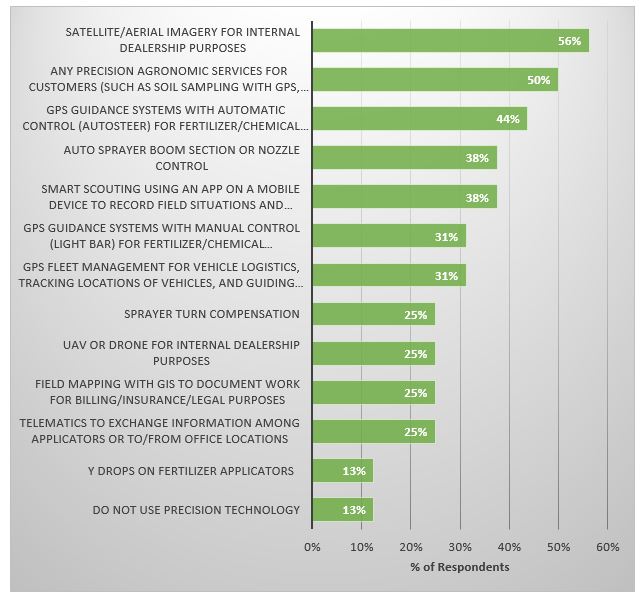

Figure 3. (Click to see full size.)

In addition to products and services offered to customers, dealers were also asked about the ways they used precision technology in their business. Satellite/aerial imagery is the most-used among the precision tools the dealers were asked about, with 56% adoption (Figure 3). This is followed by auto-guidance (44%) and sprayer boom section controllers (38%) for their custom fertilizer and pesticide applications, and smart scouting apps on mobile devices (38%). And while satellite/aerial imagery is the most adopted technology, only 25% of those who completed the survey use UAV/drones for dealership purposes.

Spraying drone for precision agriculture

Contact: Fly Dragon Drone Tech.

Email: frank at dronefromchina.com

Add: NO. 9 Dayu Road PiDu distric, ChengDu 611730, China